Recent Posts

-

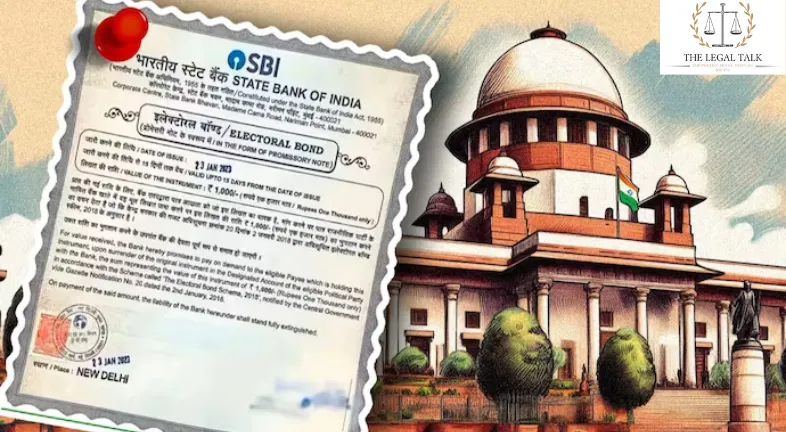

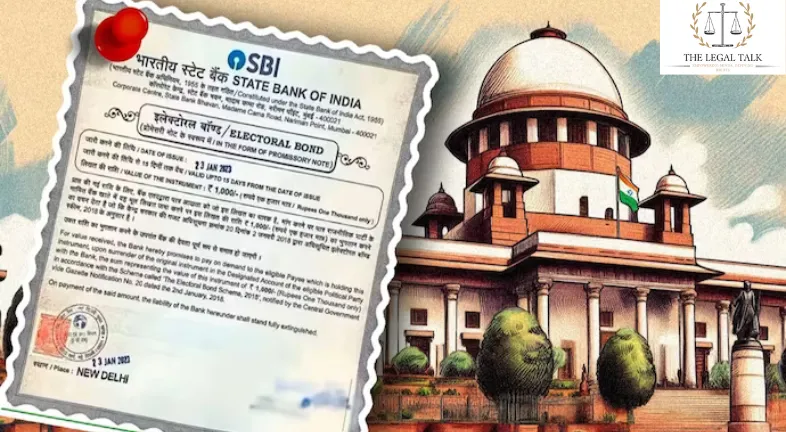

ELECTORAL BONDS SCHEME DECLARED UNCONSTITUTIONAL BY THE SC

ELECTORAL BONDS SCHEME DECLARED UNCONSTITUTIONAL BY THE SC -

Hindu Marriage cannot be dissolved by compromise under sec 125 Cr. P.C

Hindu Marriage cannot be dissolved by compromise under sec 125 Cr. P.C -

WHAT IS THE PUNISHMENT IN CHEQUE BOUNCE CASE?

WHAT IS THE PUNISHMENT IN CHEQUE BOUNCE CASE? -

How Do I Write A Complaint Letter To The Cyber Cell ?

How Do I Write A Complaint Letter To The Cyber Cell ? -

REGISTRATION OF LIVE-IN RELATIONSHIP

REGISTRATION OF LIVE-IN RELATIONSHIP -

IN WHICH COUNTRIES ABORTION IS LEGAL?

IN WHICH COUNTRIES ABORTION IS LEGAL? -

How To Recover Your Loaned Money ?

How To Recover Your Loaned Money ?

ELECTORAL BONDS SCHEME DECLARED UNCONSTITUTIONAL BY THE SC

While deciding the case of Association for Democratic Reforms & Anr. v. Union of India & Ors. (Writ Petition (Civil) No. 880 of 2017),the Supreme Court of India, declared the electoral bonds scheme as unconstitutional, hence striking it down. The Supreme Court held that the anonymity clause of the scheme is in violation to the right to information of the Constitution provided under Article 19(1)(a).

Facts of the Case-

- The petition was filed by the Association for Democratic Reforms (ADR), the Communist Party of India (Marxist), Congress leader Jaya Thakur and others, challenging that the anonymous transactions to the electoral bond is against the principle of transparent political funding which encroaches upon the right to information of a voter.

- It was also contended that the scheme helps with the contributions through the shell companies, which raises further concerns about the issue of accountability and integrity in the money being used during the election campaigns.

- The Union Government in its defence of the scheme, explained about its of promoting the use of legitimate funds in political financing, which are ensured through regulated banking channels.

- Also, the government stressed about the need for donor anonymity so as to shield the contributors from any potential retribution by the political entities.

- In addition to the matter of electoral bonds scheme, crucial observations were also made by the Court in relation to the matter related to Section 182 of the Companies Act as well as the matter related to political contributions by the companies.

- Section 182 of the Companies Act, 2013 provides for the Indian companies to make financial contributions in support of the political parties under specific conditions. The specified conditions so mentioned include- + The contributions must be authorised by the Board of Directors of the company + The decisions must not be made in cash, and + The decisions must be transparently disclosed in the Profit and Loss (P&L) account of the Company.

- But, with the Finance Act, 2017, some important changes were introduced, including-

- + The removal of the previous cap on the amount which companies could donate to the political parties, which was at 7.5% of the average profits of the last three fiscal years.

- + Also, the requirement for the companies to disclose the names of the political parties in whose favour such contributions were made in their P&L accounts was removed as well.

Judgement of the Supreme Court

A cheque bounce case frequently commences with an account holder writing a cheque to the payee, which is subsequently sent to the bank for approval. However, there can be a number of reasons why the cheque bounces, notably insufficient funds, resulting in problems for both the payer and the recipient of the cheque. After the bank’s notification of the account’s low balance, the account holder could become subject to legal penalties.

- The Constitution Bench, which comprised the Chief Justice DY Chandrachud and Justices Sanjiv Khanna, BR Gavai, JB Pardiwala, and Manoj Misra, decided the case, while underscoring the fundamental importance of transparency in political fundings. The ruling addressed the concerns of the usage of electoral bonds for personal gains of the donor, thus highlighting the importance of an open governance and access to information for the voters.

- The amendment to Section 182 of the Company Act which permitted an unlimited political contributions by the companies, was found by the Court to be arbitrary for several reasons.

- The Court noted that a disproportionate influence was being wielded by companies in the electoral process as compared to the individuals, which emphasised that transactions could be made with an intention of securing benefits in return. Thus such separate treatment of individuals and companies, made the electoral scheme as manifestly arbitrary. As a company will have a much graver influence on the political process, both in terms of the amount of money which will be contributed to the political parties as well as the purpose behind making such contributions, held the CJI.

- The Apex Court also highlighted that the failure of the amendment to differentiate between the profit-making and loss-making companies, which again overlooked the increased risk of quid pro quo transactions by such loss making company in the future.

- The Supreme Court also emphasised the unrestrained influence of the corporate world in the elections, which is abjectly against the principles of free and fair elections as well as the principle of political equality,

- After holding a three day long hearing, the Constitution Bench of the Supreme Court of India reserved the verdict last November. Also, the Court ordered the Election Commission to prepare the details of the contributions to the political parties by way of electoral bonds by September 30th.

- In case you are facing any legal matter and are in a state of confusion as to which step would be favourable for you, it is advised that you seek professional advice for the same. Sharks of Law offers you a team of the brightest and most driven lawyers who have years long experience in their field including matters related to civil law, criminal law, family law or for matters dealing with corporate law..